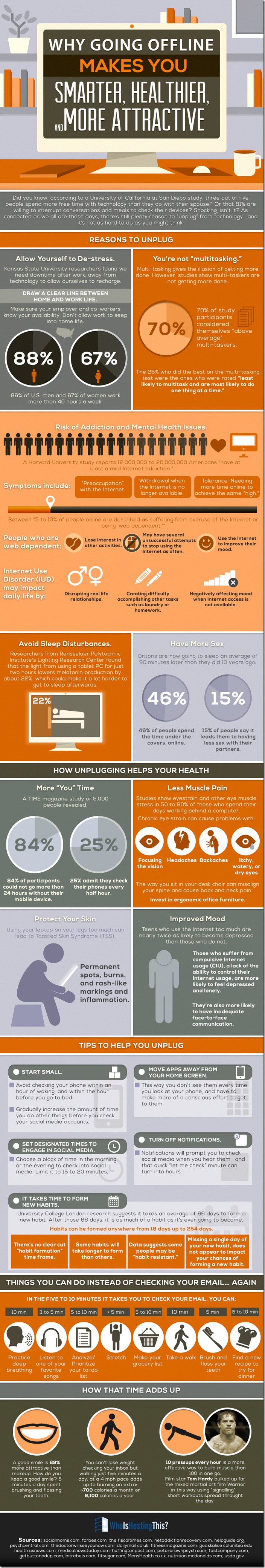

The “Tips to Help You Unplug” are especially good. I put a couple of them into play right now. Best to form a little of the new habit than none at all.

-

-

Running 5 Minutes a Day Has Long-Lasting Benefits

Originally seen on the NYTimes

Running for as little as five minutes a day could significantly lower a person’s risk of dying prematurely, according to a large-scale new study of exercise and mortality. The findings suggest that the benefits of even small amounts of vigorous exercise may be much greater than experts had assumed.

In recent years, moderate exercise, such as brisk walking, has been the focus of a great deal of exercise science and most exercise recommendations. The government’s formal 2008 exercise guidelines, for instance, suggest that people should engage in about 30 minutes of moderate exercise on most days of the week. Almost as an afterthought, the recommendations point out that half as much, or about 15 minutes a day of vigorous exercise, should be equally beneficial.

But the science to support that number had been relatively paltry, with few substantial studies having carefully tracked how much vigorous exercise is needed to reduce disease risk and increase lifespan. Even fewer studies had looked at how small an amount of vigorous exercise might achieve that same result.

So for the new study, published Monday in The Journal of the American College of Cardiology, researchers from Iowa State University, the University of South Carolina, the Pennington Biomedical Research Center in Baton Rouge, La., and other institutions turned to a huge database maintained at the Cooper Clinic and Cooper Institute in Dallas.

For decades, researchers there have been collecting information about the health of tens of thousands of men and women visiting the clinic for a check-up. These adults, after completing extensive medical and fitness examinations, have filled out questionnaires about their exercise habits, including whether, how often and how speedily they ran.

From this database, the researchers chose the records of 55,137 healthy men and women ages 18 to 100 who had visited the clinic at least 15 years before the start of the study. Of this group, 24 percent identified themselves as runners, although their typical mileage and pace varied widely.

The researchers then checked death records for these adults. In the intervening 15 or so years, almost 3,500 had died, many from heart disease.

But the runners were much less susceptible than the nonrunners. The runners’ risk of dying from any cause was 30 percent lower than that for the nonrunners, and their risk of dying from heart disease was 45 percent lower than for nonrunners, even when the researchers adjusted for being overweight or for smoking (although not many of the runners smoked). And even overweight smokers who ran were less likely to die prematurely than people who did not run, whatever their weight or smoking habits.

As a group, runners gained about three extra years of life compared with those adults who never ran.

Remarkably, these benefits were about the same no matter how much or little people ran. Those who hit the paths for 150 minutes or more a week, or who were particularly speedy, clipping off six-minute miles or better, lived longer than those who didn’t run. But they didn’t live significantly longer those who ran the least, including people running as little as five or 10 minutes a day at a leisurely pace of 10 minutes a mile or slower.

“We think this is really encouraging news,” said Timothy Church, a professor at the Pennington Institute who holds the John S. McIlHenny Endowed Chair in Health Wisdom and co-authored the study. “We’re not talking about training for a marathon,” he said, or even for a 5-kilometer (3.1-mile) race. “Most people can fit in five minutes a day of running,” he said, “no matter how busy they are, and the benefits in terms of mortality are remarkable.”

The study did not directly examine how and why running affected the risk of premature death, he said, or whether running was the only exercise that provided such benefits. The researchers did find that in general, runners had less risk of dying than people who engaged in more moderate activities such as walking.

But “there’s not necessarily something magical about running, per se,” Dr. Church said. Instead, it’s likely that exercise intensity is the key to improving longevity, he said, adding, “Running just happens to be the most convenient way for most people to exercise intensely.”

Anyone who has never run in the past or has health issues should, of course, consult a doctor before starting a running program, Dr. Church said. And if, after trying for a solid five minutes, you’re just not enjoying running, switch activities, he added. Jump rope. Vigorously pedal a stationary bike. Or choose any other strenuous activity. Five minutes of taxing effort might add years to your life.

-

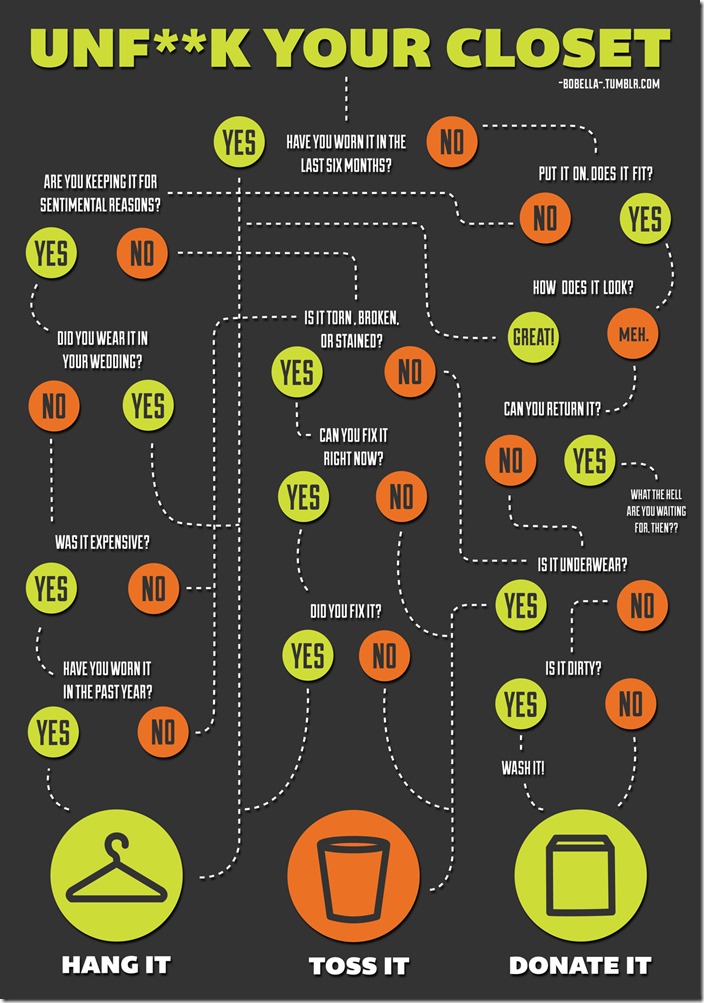

Apartment Living: Cleaning Out The Closet

Today I am going to clean out my closet for the first time in awhile.

I saw this on Lifehacker and it inspired me by providing me some real justification.

But the high school jeans? Do they have to go. Wait, guys don’t save those too, do they?

-

Emotional Intelligence

Between stimulus and response, there is a space. In that space lies our freedom and our power to choose our response. In our response lies our growth and our happiness. —Viktor Frankl

-

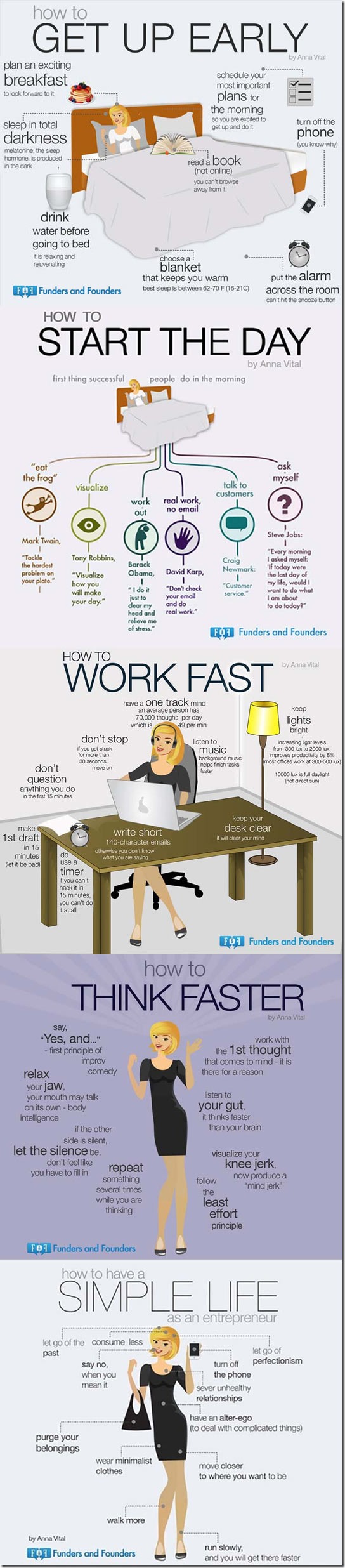

HowTo Have a Simple Life

-

How Much Can You Really Earn With the Best CD Rates?

This caught my eye from NerdWallet Finance about CD Rates and investments.

Let’s face it; today’s interest rates are pretty ho-hum across the board. They’re so low that you may be wondering if moving your money to another investment is worth the trouble. Even at current rates, small differences in earned interest really add up, especially if your investment is sizable and you’re willing to give it some time. Are high-yield CDs still your best option, and if so, how much can you realistically expect to earn?

Comparing the averages

For those who can live with the risk of losing some of their initial deposit, investments such as stocks present the chance for the highest potential gains. Many of us just don’t have the stomach for that kind of risk and volatility, however. If your risk tolerance is low, high-yield CDs are your best alternative, offering the highest interest rates of all types of government-insured investments. Even though these rates are currently on the low side, CD returns are still outpacing inflation in many cases. Here’s how the national average annual interest rates for various types of investments stack up, according to the FDIC:

- Money market account: 0.08%

- Jumbo money market account: 0.13%

- Savings account: 0.06%

- Checking account: 0.04%

- 12-month CD: 0.20%

- 12-month jumbo CD: 0.21%

- 24-month CD: 0.33%

- 24-month jumbo CD: 0.35%

- 60-month CD: 0.76%

- 60-month jumbo CD: 0.77%

Keep in mind that these figures represent national averages for rough comparison purposes and you’ll be able to find individual products in all categories offering substantially higher interest.

What do all these figures really mean to me?

At first glance, these interest rates seem disappointingly similar. However, you might be surprised at the difference your investment choice will make over time.

Suppose you start out with $20,000 and you deposit it all in a money market account at your local bank for the national average rate yield of 0.08%. Assuming you don’t add any additional funds, at the end of a year you’d have earned $16 in interest, bringing your total balance to $20,016. Wait another year and your total balance would only reach $20,032. Even if you somehow forgot about your account for five years, by the end of that time your total balance would have only grown to $20,080. In other words, you’d have to wait about five years just to earn enough interest to pay for a fancy dinner date!

If that same $20,000 investment sat in a regular savings bank account paying the national average interest yield of 0.06%, the story is even sadder. You’d end up with a total balance $20,012 after a year and $20,060 after five years.

The picture begins to change as you explore CD earnings. For example, $20,000 invested in a 12-month CD at the national average interest yield of 0.20% would earn $40 in interest by the end of one year. Not much, but it amounts to more than three times what you’d earn if your money remained in an average savings account that year.

If you were willing to wait five years for your CD to mature, you’d really see a difference in your gains, with your balance at maturity totaling $20,761 at the national average 60-month CD yield of 0.75%. That’s over $700 more than you’d earn if you’d left that money in an average bank savings account for the same period of time.

Today’s best deals

With a little homework you’ll soon discover that you don’t have to settle for national average returns. While individual bank offers vary, you’ll find some of your best deals with online banks, since they don’t carry the same overhead costs as traditional banks. Top 12-month CD offers currently range from about 0.95% to 1.07%. At 1.07%, your $20,000 investment would be worth $20,214 after 12 months.

For those willing to shop around, a five-year commitment brings even better rewards, with the best deals on high-yield CDs paying between 2% and 2.23%. At 2.23%, that $20,000 investment would be worth $22,331 when it matured at 60 months. That’s over $2,000 more than if you left your money sitting in an average savings account!

Protect your earnings

Although you’ll earn the highest interest on longer-term CDs, The Wall Street Journal reports that the majority of Federal Reserve officials believe that the government will begin increasing interest rates in 2015. If you lock in your investments for too long, you may miss out on some much better opportunities next year and beyond.

Experts recommend a laddering approach when investing in CDs. Laddering provides a balance between always having some cash ready for better investments and to protecting your portfolio’s growth should interest rates fall. To find out about the best current deals on high-yield CDs, visit NerdWallet’s CD rate comparison tool.

-

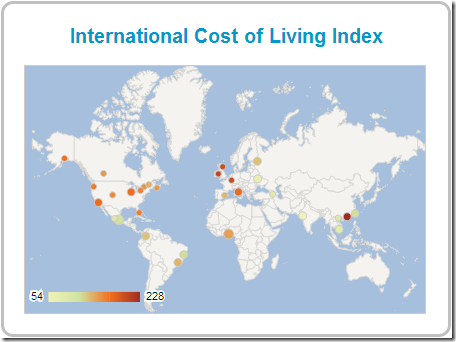

Mapping the Cheapest Cities to Teach Abroad

From Citylab on The Atlantic, finally I can figure out what it costs to teach abroad

… when wanderers wonder if their salary might stretch further in Barcelona or Milan, why not direct them to the experience of their peers? That’s the premise of Expatistan, a user-generated cost of living index designed by web developer Gerardo Robledillo.

…

After studying various reports from the United Nations and national governments, he devised a survey featuring several dozen common indicators of the cost of living — the price of a monthly transit pass, a pint of beer, a house cleaner, and so on. (National indicators alone, Robledillo says, were not so useful as source material: "The differences between a capital city and a smaller city are way bigger than different capitals from different countries.")

Since Expatistan launched in January 2010, users have entered more than 600,000 points of price data. Each individual question factors into one of six categories — like Transportation, or Housing — which then produce a final comparative judgment: "Cost of living in London is 8 percent more expensive than in New York City," or "Cost of living in Paris is 132 percent more expensive than in Budapest."

Since no government data goes into these calculations, the figures reflect the biases of the users. …..